Be it a small-to-medium sized business, large corporation, or government entity at some point it may require a credit rating. When issuing debt, initiating a securities offering (IPO), forming a partnership or merger, or other financial dealings a credit rating is requisite. This 4M Performance Guide will escort you through the corporate credit rating process.

Similar to a FICO credit score for individuals, businesses require credit scores but these scores are much more complex and paid for by the entity requiring the rating.

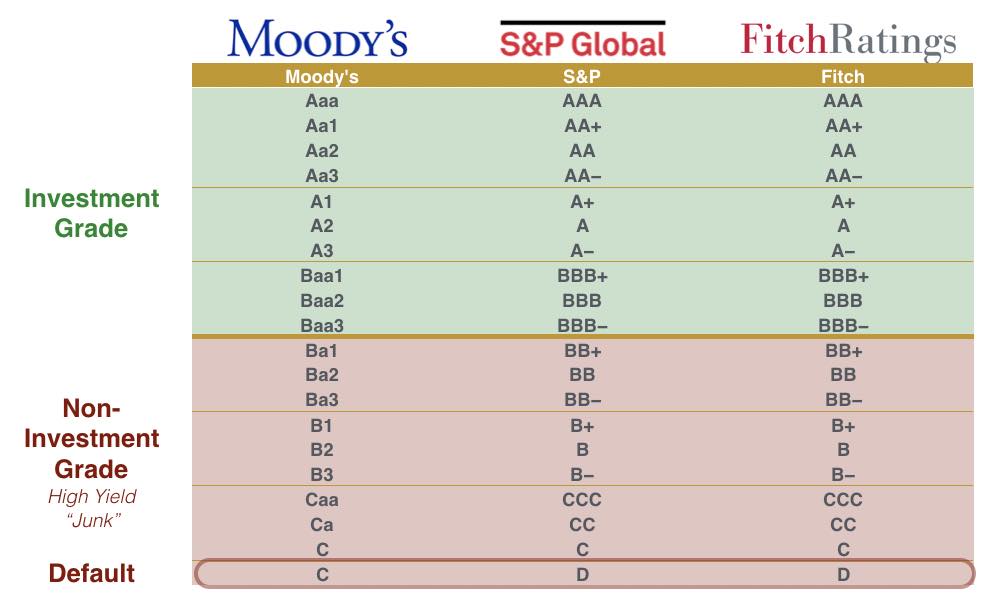

Corporate credit ratings provide opinions on the relative ability of an entity to meet its financial commitments. To arrive at the rating opinion, standardized procedures are used to ensure a globally consistent approach to the rating process. The three major corporate rating companies are Standard & Poor’s, Fitch Ratings, and Moody’s. Each uses various protocols in determining its credit ratings but the outcome is to determine if the rated company can meet its financial obligations.

Rating Process

The rating process begins when an issuer, sponsor, or underwriter contacts one or more of the rating companies with a request to engage them to provide a credit rating. It is not uncommon for an issuer to use two or even all three agencies – and select the best of the three ratings.

The ‘rating project’ is assigned to the appropriate product group within the rating company and one or more analysts are assigned to the project. They will develop a rating recommendation and bring it to a rating committee.

Analysts conduct their reviews in a manner consistent with prior criteria applicable to the issuer and asset class. They use both relevant qualitative and quantitative factors and incorporate information provided directly by the issuer. In most cases, the issuer participates in the rating process via on-site visits, virtual meetings, and correspondence. The analysts conducting the rating procedure will determine if sufficient information is available to form a view on the creditworthiness of the issuer. If that information is insufficient to form a rating opinion, no credit rating will be assigned.

Committee Process

Credit ratings are assigned and reviewed through a committee process. Committees consider the information and rating recommendation presented in the Rating Proposal (presented by the assigned analysts) and discuss the recommendation. The Rating Proposal must include a summary of key rating drivers (financial and economic), sensitivity analysis, and other pertinent information relevant to this particular rating.

Committee members are selected based on experience and seniority regarding this type of issuer. Committees are normally five but can go as high as nine members. A credit rating is assigned if the committee agrees on a rating level and that the information supporting that rating decision is sufficient and robust. Decisions are reached by consensus.

In the event that the Committee determines that further analysis or information is required before the committee can move on a vote, it will suspend its vote to allow this material to be gathered and re-presented.

Issuer Notification

Once the committee concludes, the outcome is communicated in writing to the issuer. In communicating the credit rating to the issuer, the rating action and the principal grounds on which the credit rating is based is explained in detail. The issuer is required to respond to the rating, normally in writing, and the rating company responds to confirm the issuer’s feedback and that the credit rating will be published. The rating is first published on the credit rating company’s website and then released to the major newswire services and financial press.

The timing of publication reflects the important balance between allowing sufficient time for the issuer to review the rating rationale for factual accuracy, the presence of confidential information, and providing users of credit ratings with timely and objective opinions.

An issuer may request an appeal of the rating decision. Known as an external appeal. Appeals are only granted when an issuer provides new or additional information in a timely manner and that the credit rater believes to be relevant to the credit rating.

Rating Reviews

Credit ratings are typically monitored on an ongoing basis and the review process by the credit agency is a continuous one. Credit ratings are subject to review by a rating committee, at least annually, and in some cases, every six months.

Point-in-time ratings are not monitored. Such ratings are static.

All credit ratings and reviews are the property of the rating agency. They have full discretion in determining if and when to withdraw a rating.

Summary

Corporate credit ratings reflect views of future performance based on historical financial results within various economic cycles. Typically, credit rating companies, analyze credit characteristics under different scenarios to determine the likelihood that rating expectations will be met and, if not, the extent of the variance.

This Guidebook is a product of 4M Performance. We encourage your feedback and insights. At 4MP we strive to provide businesses the knowledge to assist in their success. Visit us: 4M Performance.com.

0 Comments